Story from Hart Energy, by Jaxon Caines. The drilling market is a cyclical one, enduring many years of highs and many years of lows, but resilient. The rig market is exiting a low point, and signs point to a global market resurgence.

“The last down cycle was particularly rough and long. It lasted from about Q3 2014 until late 2019, but then COVID hit and the market took a dive again,” Cinnamon Edralin, Esgian’s head of rig market research, told Hart Energy. “In 2021 we started slowly seeing things pick up, and in 2022 we saw things pick up even more. We think we’ll see a continued trend of the market going up.”

Cinnamon Edralin (Source: Esgian)

“Operators this time are being a little bit more cautious, so we’re not seeing as many long-term tenders come out for work. This is partly a result of what happened in the previous upcycle” Cinnamon Edralin, Esgian

While the loosening of COVID restrictions is one reason activity is increasing, a multitude of factors are contributing to the rise. As the Russia-Ukraine war continues, the EU is encouraging member countries to increase production.

“We also saw a big increase in the oil and gas price last year, which is partly a reflection of the Russia and Ukraine situation. When prices are higher, that’s an incentive for more drilling,” Edralin said. “Many countries feel that they need to put more of a focus on energy security, so they’re trying to increase production in their respective places.”

Previous projects that were delayed due to low demand during the downturn between 2014 and 2021 are now moving forward. In Brazil, activity is increasing to take advantage of higher commodity prices. India is increasing production to improve energy security.

Stranded rigs

To supplement the rise in activity, operators are turning to rigs that were left stranded in the downturn. In the Middle East, most of the stranded jackup rigs have been “spoken for,” Edralin said, with most expected to end up in the active fleet. The case isn’t the same for floating rigs such as semisubmersibles and drillships.

While the newer, higher spec stranded rigs were snatched up by new owners, many floating rigs “were ordered several years ago that were on the lower specs,” Edralin said.

“Lower capability rigs are outdated technology now, so there are a few that we don’t expect will get delivered into the drilling industry,” she said. “They are good candidates to be converted into production units or offshore wind units or LNG, something along those lines, but they will not be in the drilling market.”

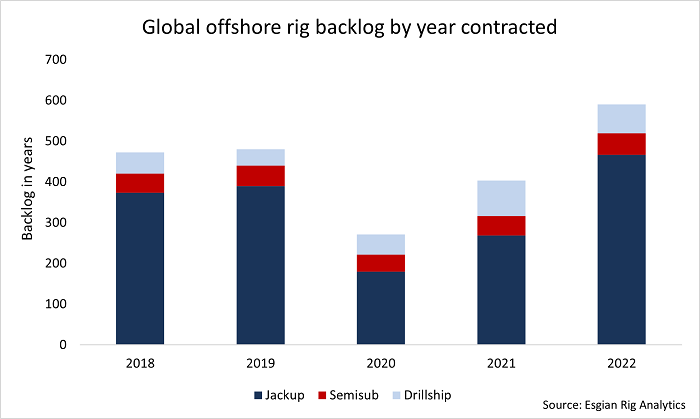

Globally, jackups are getting the most contracts, as there are about 500 rigs in the global jackup fleet. Most of the work comes from the Middle East, where a large number of multi-year contracts are being awarded. Drillships have the second largest fleet globally with around 100 total rigs. Semisubmersibles have the smallest global fleet.

(Source: Esgian Rig Analystics)

Resemblance to 2021 upcycle

The current market bears a resemblance to the 2012 strong upcycle year, Edralin said. During that time, contracts were on the rise and day rates were increasing, reaching new highs.

“Some similarities now are that day rates are going up and operators are looking at things and coming up with a lot of plans,” she said. “However, operators this time are being a little bit more cautious, so we’re not seeing as many long-term tenders come out for work. This is partly a result of what happened in the previous upcycle, when operators put out five- and 10-year contracts and were stuck paying those high rates when things crashed.”

Among the most active operators are supermajors such as Exxon Mobil, Shell and BP. While the assets of the other supermajors are more spread out worldwide, Exxon Mobil is placing a lot of focus in Guyana, where they are making discoveries “left and right,” Edralin said. Chevron is also very active in the drilling market and in the second quarter of 2023, will put Transocean’s new eighth generation drillship, the Deepwater Titan—which is equipped with two 20,000 psi-BOPs—to work at its Anchor acreage in the deepwater Gulf of Mexico.

National oil companies such as Saudi Aramco, India’s ONGC and Petrobras are incredibly active as well, Edralin said. Petrobras has been ramping up activity and picking up floating rigs for their Buzios and BMS 11 projects.

Activity in all phases of the drilling market remains strong, no matter the size of the global fleet.

“When you look at the market, you tend to have your ups and your downs. But now we’re thinking things are going to be up pretty steep, steeper than the last couple of ups, and for a longer period of time,” she said. “We’re calling this a multi-year super cycle.”

End of Story.