Story By Zoltan Ban. |Seeking Alpha| Investment thesis: Chesapeake (NASDAQ:CHK) seems like a very obvious bet as the US competes for dominance of the global LNG market, on the back of rising shale gas production. Chesapeake’s production is predominantly shale gas, while its Haynesville acreage directly benefits from the LNG export trade on the GOM coast, making it an interesting investment prospect, which is why I invested in its stock earlier this year.

The recent plunge in shale drilling puts into question the future of the entire shale industry. On one hand, lower production on the horizon can help to bolster domestic natural gas prices. On the other hand, it looks like lower production is on the horizon and it seems to be industry-wide. It raises questions about Chesapeake having the right resource base, just as it is the case for the rest of the industry. At this point, it is largely an unknown and it is a potential risk, as well as a potential chance for Chesapeake to be one of the last producers to increase natural gas production, even as much of the rest of the industry will pull back, pushing natural gas prices higher in the future. At this point, there is simply not enough to go on for us to be certain which outcome will be more likely, but based on what we know, Chesapeake seems to have the right acreage going forward.

Chesapeake is regaining a reputation as a profitable shale gas producer with every quarter that passes

For the first quarter of this year, Chesapeake managed to put in a very solid financial result, going by most metrics. Net earnings came in at just under $1.4 billion, on revenues of just under $3.4 billion. Production increased from 3,247 MMcf for the first quarter of 2022, to 3,651 MMcf for the current quarter. Interest costs remained low at just $37 million for the quarter, which is just over 1% of revenues. Overall, there is very little that one can point to as a negative. If it were not for the low natural gas price environment we are seeing right now, Chesapeake’s stock price would have probably rallied since the financial report’s release at the beginning of the month.

Its stock price has seen an improvement since then, but perhaps nowhere near as impressive as one might have expected from such an impressive performance in terms of certain metrics such as its profit margins of about 41% for the quarter.

The shale revolution seems to be entering its production growth reverse stage, and early signs suggest that Chesapeake may be no exception

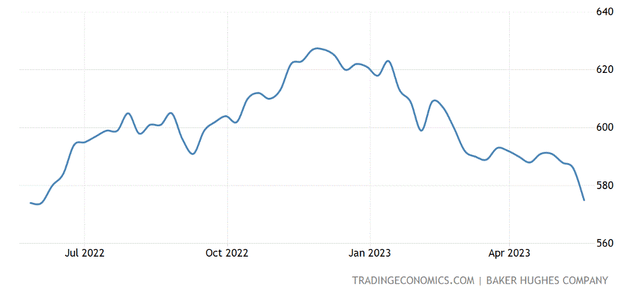

A leading indicator in terms of where the US shale production trends are headed tends to be the weekly rig count that Baker Hughes provides to the public.

As we can see, the decline started in the fall of last year, and in the past few weeks, it seems to have accelerated. Some factors being cited for this trend include the issue of the LNG export terminal that was out of commission for months due to an explosion, which helped to cause a natural gas glut domestically. The problem with it is that the decline in drilling covers all fields, and it includes oil, not just natural gas. As of right now, the number of rigs that target natural gas declined by about 6% compared with last year, while the number of oil rigs is down by about .2% from last year.

READ NEXT: Drilling Giant Chesapeake Cuts Rigs Amid Plunge In U.S Gas Prices

The explanation that is most often avoided from most reporting on the issue is the likelihood of prime acreage drilling opportunities declining. Second-tier acreage can be drilled, but it requires much higher oil & gas prices to make it worthwhile to take the risk. Plenty of shale drillers went bust last decade, trying to make it on drilling mostly second-tier acreage. The ones left standing mostly succeeded by consolidating their drilling activities in their prime acreage assets.

In the event that the industry-wide trend of slowing drilling activities will persist going forward, we will probably start to see the start of a sustained decline in production perhaps by the end of this year or at some point in the first half of 2024. In some ways, this is good news for the short term for most drillers, especially those involved in gas production, where the local market is more prominent in determining the price that producers will get. In the longer term, it means that most shale companies are looking at the beginning of their slow shrinking, first of production, even as revenues might actually go the other way and increase, followed by both production as well as revenues declining once production will shrink to the point where higher oil & gas prices will no longer cover for the loss of production volumes.

There are of course those companies that in theory can sustain current production for many years to come, and perhaps even increase production substantially if they choose to, on the back of ample prime acreage reserves. It is very difficult to ascertain which companies have the right reserves under their belt and which ones are running out of viable places to drill. In hindsight, we will see it, as certain companies will be winding down their drilling activities much faster than others, while a few might even dare to increase drilling going forward. Hindsight is not always particularly useful for investors, however, so it is worth trying to figure out where each company most likely stands in this regard.

In the case of Chesapeake, production did rise until recently, as I already cited. Going forward, Chesapeake seems to be joining the overall industry by pumping the brakes on drilling and production growth.

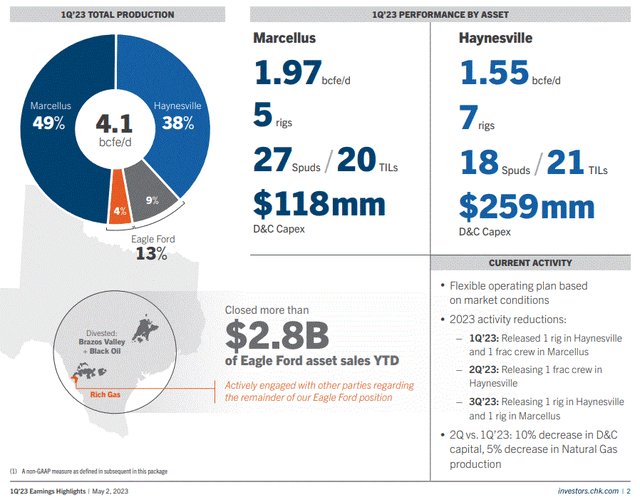

As we can see, Chesapeake is liquidating its Eagle Ford assets, while in the Haynesville and Marcellus fields, it is ceasing the operations of five rigs this year, two in the Marcellus, and three in Haynesville. It is also expecting a decline in natural gas production of 5% this year.

It is unclear why Chesapeake’s reduction in drilling is happening. The Haynesville reduction in activities may be in line with the explanation that a decline in LNG shipments on the coast, due to the export terminal outage. It does not explain the reduction in the Marcellus. It can be explained as a response to the steep decline in natural gas prices.

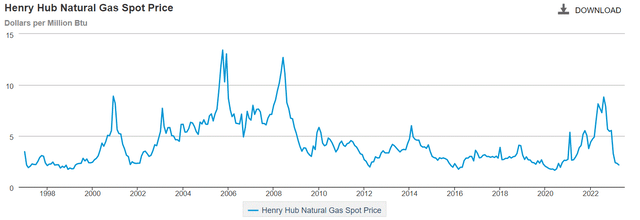

Looking at the Henry Hub spot price, the plunge in US natural gas drilling makes some sense as a probable culprit, after all, current price levels are close to all-time lows. The only piece of the puzzle that does not fit is the fact that a significant decline in rigs targeting oil resources has also taken place and it is widespread. Oil prices have been trading at around $70/barrel, therefore the decline cannot be attributed to market price signals. Looking at the whole picture, I am personally inclined to view the recent pace of decline in oil drilling to be a reflection of the industry trying to preserve whatever is left of the dwindling prime acreage still available for drilling.

The decline in Chesapeake’s own drilling activity cannot currently be attributed to either the market price signal effect or to the probable desire of the wider shale industry to preserve whatever is left to be drilled in the prime acreage category. Perhaps it is a combination of both, where the low price of natural gas is making the drilling of increasingly scarce prime acreage either undesirable or perhaps even unviable, in other words even the prime acreage that Chesapeake and other companies are sitting on is economically unviable at current market prices.

Investment implications:

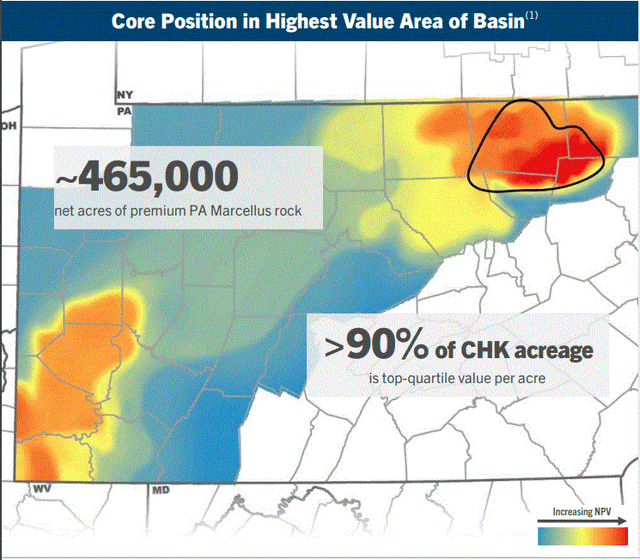

The long-term future prospects of Chesapeake seem secure, anchored in what we can assume to be good-quality acreage in fields like the Marcellus, where Chesapeake is positioned well within the core of the field.

Chesapeake

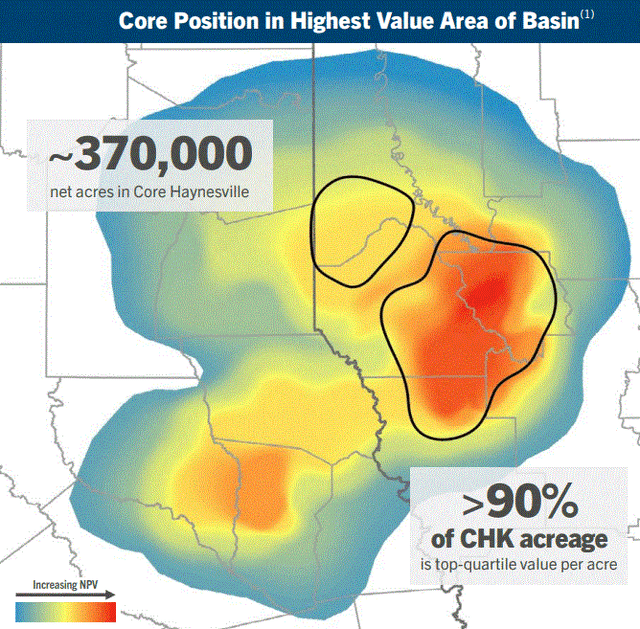

The Haynesville acreage seems to be perhaps less impressive, with some of it located outside of the core area.

Chesapeake

Such maps help us to provide some clues in regard to where Chesapeake stands in terms of its acreage quality and prime reserve life left, but it is by no means perfect.

Assuming that Chesapeake is still sitting on a sizable inventory of prime acreage that is still left to be drilled, it may benefit in the long term as it is increasingly obvious that much of the overall industry is starting to cut back on drilling, precisely due to a lack of such acreage available to more and more companies. In the shorter term, the industry-wide plunge in natural gas drilling activity suggests that significantly higher prices are on the way because clearly, the industry is not willing to drill within the current market environment.

There is of course the risk that investors will be in for a surprise and learn that despite appearances, Chesapeake is not sitting on ample prime acreage drilling opportunities, but based on what we know, it does not seem to be the case that Chesapeake is running out of prime acreage. I announced my cautious venture into owning some Chesapeake stock back in February and based on the evolution of the overall market, the industry as well as Chesapeake’s response so far, I continue to maintain my cautious position. In the absence of any other changes in the market or in Chesapeake’s own known situation, I still intend to add more shares if we were to see a significant drop of 25% or more in its stock price from current price levels, assuming that it is market-driven, not due to any particular factors affecting the company.