MarketWatch| Saudi Arabia will voluntarily cut oil production by an additional 1 million barrels a day in July, alongside an agreement on Sunday by the Organization of the Petroleum Exporting Countries and its allies to stick to production targets.

Describing the voluntary cut as a “Saudi lollipop,” the country’s energy minister, Prince Abdulaziz bin Salman, told reporters that the July reduction could be extended if needed.

OPEC+ — the group made up of OPEC and its Russia-led allies — concluded a contentious meeting in Vienna, with members agreeing to extend previously agreed production cuts through the end of 2024. OPEC+ agreed last October to cut output by 2 million barrels a day. Several OPEC+ members followed that in April with the surprise announcement of 1.6 million barrels a day in additional cuts.

As part of the April cut, Saudi Arabia voluntarily agreed to trim production by 500,000 barrels a day through year-end.

Oil futures opened sharply higher Sunday evening. August Brent crude BRN00, 0.89% BRNQ23, 0.89%, the global benchmark, was up $2.26, or 3%, at $78.39 a barrel. West Texas Intermediate crude for July delivery CL00, 1.07% CL.1, 1.07% CLN23, 1.07% was up $2.24, or 3.1%, at $73.98 a barrel.

Oil prices have fallen sharply since the October reduction amid worries over the global economic outlook, with Brent crude down more than 20%. The surprise April cuts initially boosted prices, with Brent jumping $7 a barrel the following week, but gains evaporated by month-end to make new lows for 2023.

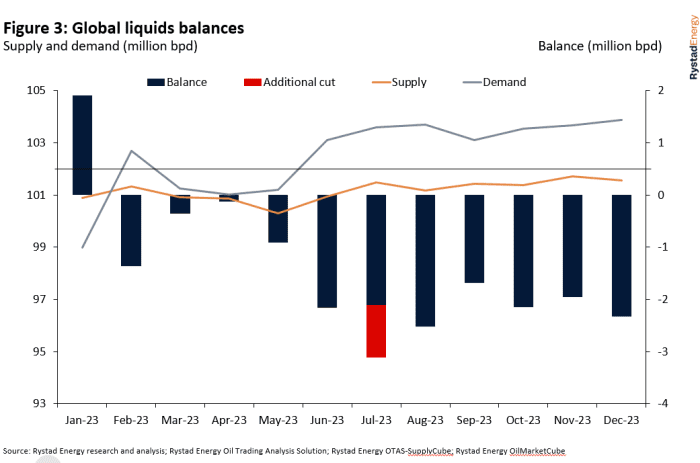

Analysts, however, had already been looking for the oil market to move into deficit in the second half of the year.

The additional cut from Saudi Arabia will add “limited short-term upside price pressure” in the coming weeks, said Jorge León, senior vice president at Rystad Energy, in emailed comments.

“The long-term price development will hinge on macroeconomic sentiment and the possible extension of the voluntary Saudi Arabian cut beyond July,” he wrote. “The pure possibility of the Saudi production cut extending beyond July will limit downside price pressure for the rest of 2023.”

RYSTAD ENERGY

News reports described the meeting as contentious. Some countries, particularly African producers, resisted calls to make further cuts before ultimately agreeing to roll over reductions into next year, the Wall Street Journal reported, with Saudi Arabia’s voluntary cut helping to get the deal over the line.

Several African countries have struggled to meet existing production quotas, which has meant that past cuts have often been less than advertised. Production capacity has suffered due to underinvestment, with conditions exacerbated by the COVID pandemic.