While there’s been a lot of angst over the shrinking US inventories, there are yet to be any concrete signs of a slowdown in American exports.

Oil, Exports and Europe. Story By Devika Krishna Kumar, Sharon Cho, and Alex Longley — (Bloomberg) — Oil buyers across the planet are facing some of the highest premiums for supplies they’ve seen in months — or longer — as dwindling stockpiles at the largest US storage hub reverberate through markets from Asia to the Middle East to Europe.

Most Read from Oklahoma Minerals

Flagship US crude cargoes on offer in Asia are coming in at the costliest premium this year. The spread between Brent and Middle East oil has jumped to the highest since February, while the premium for near-term US supply is close to the highest since July 2022.

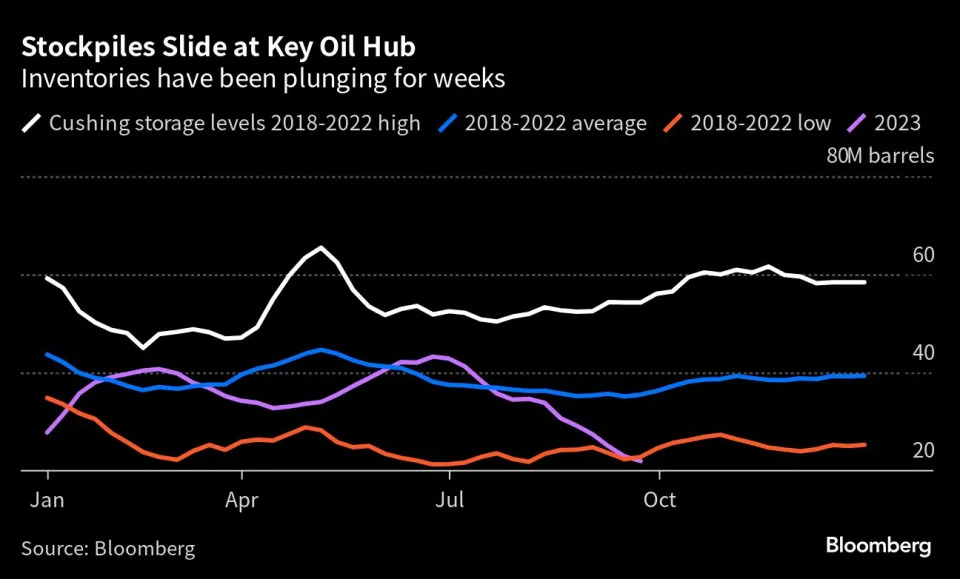

At the center of the story is Cushing, Oklahoma, the delivery point for benchmark US crude futures, which help to set the price of oil across the Americas and beyond. Inventories at the hub are now sitting just above seasonal lows last seen in 2014. That’s happening just as the world was already facing a tight supply situation with Saudi Arabia and Russia cutting output.

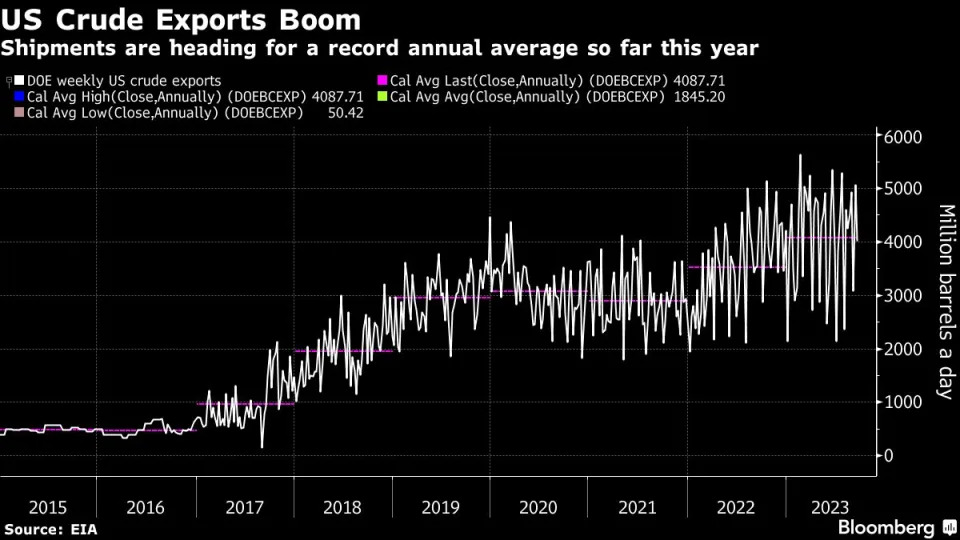

In recent months, the US had helped fill a void left in the market, routinely sending more than 4 million barrels every day to whet global appetite. Between overseas shipments and strong domestic demand, stockpiles quickly declined in the US. Now there’s a question of whether those flows will continue.

“We’re running out of oil – you can see how low storage is at Cushing,” said Gary Ross, a veteran oil consultant turned hedge fund manager at Black Gold Investors LLC. “If we’re running out at Cushing, then we’re running out in Europe because it relies on US exports. If the US exports less, then where is Europe going to get its oil from?”

Cargoes of West Texas Intermediate Midland crude for January delivery to Asia are being offered for sale at premiums of $9 a barrel above benchmark Dubai oil, according to traders who buy and sell the grade. That would be the highest premium seen this year, data compiled by Bloomberg show. Actual trading will likely start next week, giving more clarity on how much stronger the market for US barrels has gotten.

In the futures market, the surge is already apparent. The tightness in US supplies narrowed the gap between US crude and international benchmark Brent to under $3 a barrel, the smallest since May last year. Meanwhile, the spread between Brent and Middle East’s Dubai marker — also known as Brent-Dubai EFS — has skyrocketed.

While there’s been a lot of angst over the shrinking US inventories, there are yet to be any concrete signs of a slowdown in American exports.

“Waterborne exports in October are still likely to come in close to 4 million barrels a day,” said Matt Smith, oil analyst at Kpler. “The lagged impact of the tightening Brent-WTI spread means we may not see the full impact until November’s loadings.”

For November and beyond, it’s still likely exports will hover around the 4 million barrels a day level, Smith said, citing strong domestic shale production.

Traders also point to inventories being fairly robust in the Gulf Coast region as a sign that US exports could continue to remain strong for a few weeks. Heavy seasonal refinery maintenance work in the US alongside turnarounds in Europe should also offer a cushion and free up some supplies.

Already, prices for WTI in Midland and WTI at Houston are weakening relative to prices at Cushing. If that continues, it could re-open the arbitrage window to ship crude profitably to Asia. It should also help to send more barrels to Cushing.

Still, there are signs that some European refiners are having to pay up for immediate supplies.

Angola’s Sonangol sold four cargoes as much as $1.50 a barrel above offer prices over the past week, with three of the shipments likely going to Europe. Those cargoes would usually be destined for Asia — the atypical trade pattern reflects some of the market’s sharp swings this week.

“The premiums are going nuts everywhere,” Ross said. “The Saudis have tightened this market up dramatically.”

–With assistance from Lucia Kassai, Sherry Su and Bill Lehane – ©2023 Bloomberg L.P.