HART ENERGY – U.S. oil and gas production is forecast by the Energy Information Administration (EIA) to rise thanks primarily to higher volumes from the Permian and Haynesville Shale Basins.

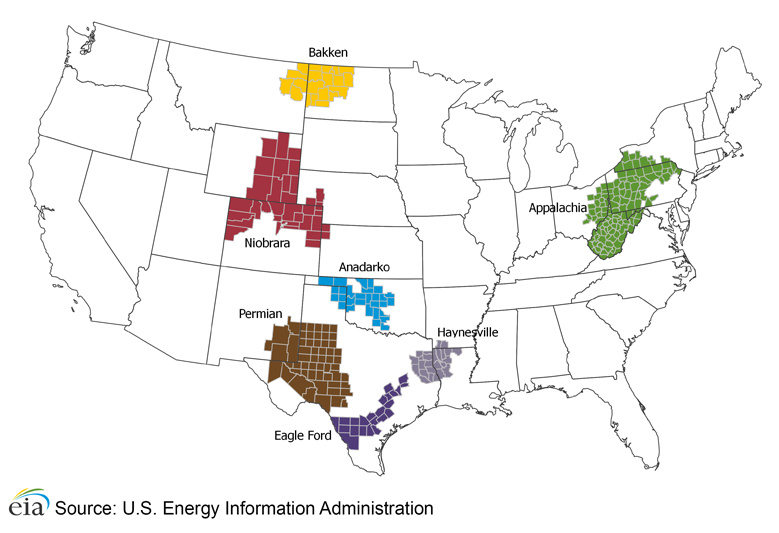

Combined oil and gas production from seven key U.S. basins—Anadarko, Appalachia, Bakken, Eagle Ford, Haynesville, Niobrara and Permian—will rise slightly in November compared to October. Oil production in the U.S. is expected to average 9.1 million bbl/d in November while gas production is expected to average 95.1 Bcf/d, the EIA revealed Oct. 17 in its monthly drilling productivity report.

U.S. gas production from the key seven basins—with Appalachia and the Permian Basin leading the push—continue to support rising U.S. LNG exports as well as piped gas exports to south of the border neighbor Mexico.

For its monthly drilling productivity report, the EIA tracks oil and gas production in seven key tight oil and shale regions in the U.S. comprising of the Anadarko, Appalachia, Bakken, Eagle Ford, Haynesville, Niobrara and Permian basins.

Russia’s invasion of Ukraine has negatively impacted global gas supplies and flows especially into Europe. The continent’s urgent need to procure gas from countries other than Russia has pushed up its demand for U.S.-produced LNG and helped convert the North American country into the world’s leading LNG exporter.

Europe’s demand for U.S. LNG is only expected to continue to rise this winter and next, many energy sector executives and pundits argued earlier this month at an energy forum in London.

MINERAL OWNERS: LEASE OR SELL YOUR MINERAL RIGHTS IN OKLAHOMA OR TEXAS. START HERE. WE HAVE PRIVATE EQUITY FUNDS LOOKING FOR LEASES IN OKLAHOMA. CALL TO GET AN OFFER (405) 492-6277

Oil Growth

U.S. oil production growth will primarily be driven by rising volumes in the Permian Basin followed by the Bakken and Eagle Ford, the EIA said.

Oil production from the Permian Basin is expected to average 5.5 million bbl/d in November, accounting for 60% of the U.S.’s total monthly production. Production from the Bakken and Eagle Ford will kick in for 13% each with the remaining 14% coming from the other basins.

However, higher oil production is not likely to be that beneficial to the U.S. refining industry and ultimately fuel consumers, according to Wells Fargo equity analyst Roger D. Read.

“We believe policy risks have substantially increased as seasonally stronger winter demand approaches amid record low inventories… We see little the U.S. refining industry can do to deliver more refined products given the U.S. refining system is already running at high levels of utilization and production,” Read wrote Oct. 16 in a research note to clients.

“We do not believe an export ban would ultimately be effective, and it might well be counterproductive,” he added.

Gas Growth

U.S. shale gas production growth will primarily be driven by rising volumes in the Haynesville and then the Permian Basin and Eagle Ford

Despite Haynesville leading the production rise next month, Appalachia and Permian are the basins that are the largest in terms of total U.S. production. Gas production from the Haynesville is expected to average 16.1 Bcf/d in November, accounting for just 17% of the U.S.’s total monthly production.

In November, shale gas production from Appalachia and Permian is expected to average 35.7 Bcf/d and 21.1 Bcf/d respectively, according to EIA data, and account for 38% and 22% of the U.S.’s total monthly production.

Gas production from the Eagle Ford will average 7.3 Bcf/d and account for 8% of total monthly production. The remaining 16% of projected gas production in the U.S. comes from other basins.

More Gas, Higher Bills

While just around 20% of U.S. gas production is exported to Mexico as piped gas and to other countries as LNG, the North American country’s rising shale gas production profile will do little to shelter U.S. households from higher bills this winter.

RELATED: How High Can U.S. Shale Production Climb?

Many U.S. households across the country are likely to spend more on energy this winter compared to recent winters, the EIA announced Oct. 12 in its Winter Fuels Outlook report.

“Higher forecast energy expenditures are the result of higher fuel prices, combined with higher heating demand because of a forecast of slightly colder weather than last winter,” the U.S. agency said.

U.S. households that “primarily use natural gas for space heating will spend an average of $931 on heating this winter (October–March), which is $206, or 28%, more than last year,” the EIA report said.

Approximately 47% of U.S. homes utilize natural gas as their primary heating fuel, according to the U.S. Census Bureau’s 2021 American Community Survey.

STORY FROM HART ENERGY