Featured Article

-

2.3KInvesting

2.3KInvestingOil Patch Property Valuations Play Key Role in Company’s Financial Health

From mineral rights and royalty interest owners to oil and gas producers and their shareholders to local, state and federal governments, the...

-

2.9KProduction

2.9KProductionIn cutting deal, OPEC optimistic about oil market

The world’s major oil producers, (aka OPEC) on Thursday agreed to keep a lid on production for another year as they attempt...

-

2.3KRig Count

2.3KRig CountRig Count Update November 22, 2017

Due to Thanksgiving, the rig count report by Baker Hughes which normally comes out on Friday, came out last Wednesday, November 22nd,...

-

10.2KScoop & Stack

10.2KScoop & StackArkoma Basin: Sooner or later, everything old becomes new again – or does it simply become LESS old?

And, so it is with the Arkoma Woodford play in southeastern Oklahoma. One of the earliest unconventional dry gas plays in the...

-

2.1KExploration

2.1KExplorationSenate May Approve Drilling In Alaskan Wilderness With Tax Bill

Drilling in Alaska’s Arctic National Wildlife Refuge may soon be a reality, as Republicans are on the cusp of accomplishing two major...

-

1.8KRig Count

1.8KRig CountRig Count Update November 17, 2017

OKLA loses 1 rig while US Rigs climb by 8. The number of oil rigs stayed flat this week, while the number of gas...

-

3.5KExploration

3.5KExplorationWhistling Past The Graveyard – Minerals Under Oklahoma Cemeteries

In rural Oklahoma, when running title on specific tracts near a town or townsite, an examiner may run into an issue of...

-

4.1KInvesting

4.1KInvestingContingent payments become more common in oil patch deals

Exxon Mobil Corp.’s deal in January for a swath of Permian Basin drilling real estate came with a sweetener for the sellers. The heirs of oil...

-

2.1KRig Count

2.1KRig CountRig Count Update November 3, 2017

Oklahoma drops 8; U.S. oil rig count falls by most in week since May 2016 U.S. energy companies cut eight oil rigs...

-

2.6KRig Count

2.6KRig CountRig Count October 27, 2017

US Rig County drops by 4, OKLA gains 1. Weekly Summary: Rigs engaged in the exploration and production in the U.S. totaled...

Snippets

- ☕️What Else is Brewing Tuesday MorningTrump announces 25% tariff on countries that buy Venezuelan oil...Trump announces 25% tariff on countries that buy Venezuelan oil and gas. As of April 2, a day President Trump has dubbed “Liberation Day” for the economy, countries that buy oil from Venezuela will have to pay an additional 25% tariff on trade with the United States, the president said on Truth Social. Precisely what other tariffs might go into effect that day remains unclear. News outlets reported that the president would not impose blanket tariffs but would focus on more industry-specific ones, and even though reciprocal tariffs are still on the menu, there might be exemptions for some countries. But officials cautioned that the situation could still change. The president also said additional tariffs on cars and pharmaceuticals would be coming soon.Read More

A federal judge refused to lift his order barring the government from deporting anyone under the rarely used Alien Enemies Act, which the Trump administration invoked to deport alleged Venezuelan gang members. An appeals court also held a hearing on the issue during which one judge said “Nazis got better treatment” under the act than the people who were recently deported, since the former got hearings.

Chinese EV-maker BYD made more than $100 billion in sales last year for the first time.

Turkish authorities arrested more than 1,100 people, including journalists, amid protests over the decision to jail a political rival of President Recep Tayyip Erdoğan.

South Korea’s Hyundai plans to invest ~$21 billion in the US, including $5.8 billion towards a steel plant in Louisiana.

Mia Love, the first Black Republican woman elected to Congress, has died of cancer at age 49.

Warren Buffett will pay $1 million to an employee who won his company’s March Madness bracket challenge—which Buffett made easier this year in hopes of having a winner—by correctly calling 31 of the 32 games in the first round of the men’s tournament. - Oil prices finish higher after Trump's threat to buyers of crude from VenezuelaOil futures settled higher on Monday after President...Read More

Oil futures settled higher on Monday after President Donald Trump said in a Truth Social post that countries that purchase oil from Venezuela will face a 25% tariff on all of their imports to the U.S. starting April 2. He also imposed new tariffs on Venezuela, according to the Associated Press.

The decision to impose tariffs on buyers of crude from Venezuela is "based on the alleged arrival of tens of thousands of Venezuelan migrants with violent backgrounds, which has been presented as a threat to U.S. national security," said Antonio Di Giacomo, a financial markets analyst at XS.

He said the impact on the energy market was immediate. Prices climbed Monday, with the May contract for West Texas Intermediate crude up 83 cents, or 1.2%, to settle at $69.11 a barrel on the New York Mercantile Exchange. May Brent crude settled at $73 on ICE Futures Europe, up 84 cents, or 1.2%.

- U.S. stocks end sharply higher Stocks jumped Monday on optimism that President Donald...Read More

Stocks jumped Monday on optimism that President Donald Trump may hold back from implementing some of his wide-ranging tariff plans and so the U.S. could skirt an economic slowdown from a protracted trade war.

The Dow Jones Industrial Average jumped 597.97 points, or 1.42%, to end at 42,583.32. The S&P 500 added 1.76% and closed at 5,767.57, while the tech-heavy Nasdaq Composite gained 2.27% to settle at 18,188.59.

Shares of Tesla which have fallen nine straight weeks, were up nearly 12%, adding to their Friday gains. Meta Platforms and Nvidia each climbed more than 3%.

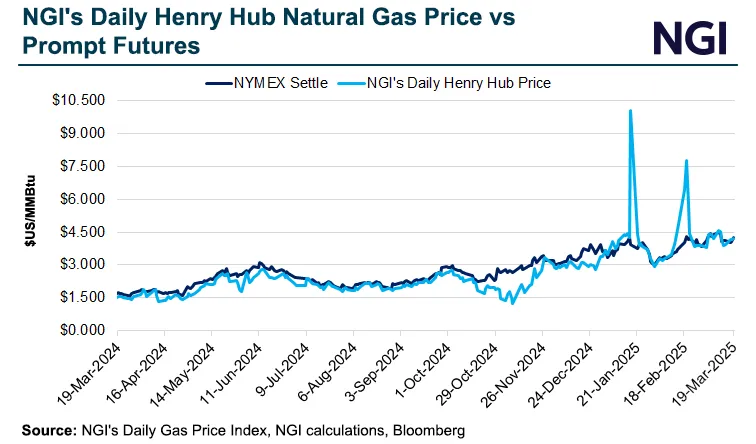

- As Stock Market Swoons Amid Tariff Fallout, Natural Gas Futures Prove Safe HavenDespite spring weather and rapidly fading heating demand, natural gas futures hold strong at winter price...Despite spring weather and rapidly fading heating demand, natural gas futures hold strong at winter price levels.Read More

To be sure, seasonally soft supply in storage and record levels of export demand are key drivers. However, traders said a stock market slump has proved to be another bullish factor for natural gas prices over the past month.

- Phillips 66's Lake Charles refinery may get $99M upgradePhillips 66 is pursuing a $99 million expansion of its 264,000-barrel-per-day...Phillips 66 is pursuing a $99 million expansion of its 264,000-barrel-per-day Lake Charles refinery in Louisiana, with proposed upgrades ranging from a steam turbine power generator to a naphtha fractionator. The project, under review for state tax incentives, could be finalized in late 2027.Read More

MOST POPULAR

-

233Exploration

233ExplorationRystad Predicts ‘Significant Risks’ to USA Operators

by Andreas Exarheas|RigZone.com| In a market update sent to Rigzone by the Rystad Energy...

-

211Oil & Gas News

211Oil & Gas News$10B Data Center, Energy Hub to Transform Old Pa. Coal Site

Story by Darrell Proctor | PowerMag.com | Officials in Pennsylvania have announced the redevelopment...

-

202Exploration

202ExplorationChevron to ‘Triple-Frac’ Half of Permian Oil Wells in 2025 to Cut Costs, Time

By Sheila Dang -HOUSTON | REUTERS—U.S. oil major Chevron told Reuters that it plans...

-

188Oil & Gas News

188Oil & Gas NewsPearsall Shale Delivers Surprise Gusher in Frio County

A long-overlooked shale play in South Texas might finally be showing signs of promise,...

-

180Oil & Gas News

180Oil & Gas NewsTrump’s Tariff Policy Threatens ‘Golden Age’ of Oil & Gas

In the wake of President Donald Trump’s re-election in November 2024, his administration swiftly...

-

170Oil & Gas News

170Oil & Gas NewsChevron to Cut Jobs, Move HQ to Houston

Chevron Corporation has announced plans to lay off approximately 600 employees at its former...

-

110Oil & Gas News

110Oil & Gas NewsWhat Comes After the Shale Era Ends?

Over the past two decades, the U.S. shale revolution has dramatically transformed the global...

-

103International

103InternationalCanadian Oil CEOs Brace for Recession, Avoid Panic Moves

As oil prices sink to their lowest levels in four years and the risk...

-

103Exploration

103ExplorationInterior Department Says More Oil Discovered Under Gulf of Mexico

(UPI) — The Department of Interior on Thursday released an analysis of fossil fuel...

-

88Oil & Gas News

88Oil & Gas NewsWhere Next for Oil Prices?

by Andreas Exarheas|RigZone.com|Where next for oil prices? That’s the question Stratas Advisors looked at in...

-

57Oil & Gas News

57Oil & Gas NewsIndia Oil Import Price Drops Below $70 for the First Time Since 2021

By Tsvetana Paraskova for Oilprice.com | The average price of India’s crude oil imports...

-

55Oil & Gas News

55Oil & Gas NewsOil Prices Are Recovering, But Can Exporters Outlast the Tariff Circus?

By Irina Slav for Oilprice.com | Oil prices have been on the mend this...