Featured Article

-

1.4KOil & Gas News

1.4KOil & Gas NewsOPEC, Russia gain power with Shell Dutch ruling

By: Dimitry Zhdannikov – Reuters – Climate activists who scored big against Western majors last week had some unlikely cheerleaders in the...

-

1.7KOil & Gas News

1.7KOil & Gas NewsChesapeake, Once Bankrupt, Is Winning Fans on Wall Street

By: Avi Salzman – Barrons – Chesapeake Energy, the Oklahoma oil and gas producer that emerged from bankruptcy in February, was Exhibit A...

-

1.3KOil & Gas News

1.3KOil & Gas NewsBakken production forecasts expected to retreat this summer as DUC wells decline

By: Brandon Evans – S&P Global Platts – Although Bakken natural gas production rebounded over the past year, volumes look to dip...

-

1.4KOil & Gas News

1.4KOil & Gas NewsExxon vs. Activists: Battle Over Future of Oil and Gas Reaches Showdown

By: Christopher M. Matthews – WSJ – For years, Exxon Mobil Corp. didn’t have to pay much attention to investors because of its...

-

1.5KInvesting

1.5KInvestingCabot Oil & Gas and Cimarex Energy Agree to $17B Merger

By: Reuters – Cabot Oil & Gas Corp (COG.N) and Cimarex Energy Co (XEC.N) on Monday agreed to merge to form a U.S. oil and...

-

3.7KInvesting

3.7KInvestingKayne Anderson Energy Funds Announce Consolidation Under 89 Energy III, LLC

Business Wire – Kayne Anderson Energy Funds is pleased to announce the all-equity consolidation of Casillas Petroleum Resource Partners, LLC, Native Exploration...

-

1.4KOil & Gas News

1.4KOil & Gas NewsThe Pursuit Of Proppant – Unheralded But Significant Ingredient In Fracking Operations.

By: Ian Palmer – Forbes – Fracking operations are at the center of the shale revolution which has transformed the US energy...

-

1.2KOil & Gas News

1.2KOil & Gas NewsEnd new oil, gas and coal funding to reach net-zero, says IEA

By: Nina Chestney – Reuters – Investors should not fund new oil, gas, and coal supply projects if the world wants to...

-

1.1KOil & Gas News

1.1KOil & Gas NewsGoldman Traders Caught in Mexico Stalemate Chasing $400 Million From Texas Freeze

By: Michael O’Boyle & Sridhar Natarajan – Bloomberg – It’s a Wall Street nightmare. You score hundreds of millions of dollars on...

-

1.3KInvesting

1.3KInvestingJPMorgan vows to help oil and gas clients reduce their carbon intensity

By: Eklavya Gupte – S&P Global Platts – Global investment bank JPMorgan Chase, which is one of the largest financiers to the...

Snippets

- ☕️What Else is Brewing Tuesday MorningTrump announces 25% tariff on countries that buy Venezuelan oil...Trump announces 25% tariff on countries that buy Venezuelan oil and gas. As of April 2, a day President Trump has dubbed “Liberation Day” for the economy, countries that buy oil from Venezuela will have to pay an additional 25% tariff on trade with the United States, the president said on Truth Social. Precisely what other tariffs might go into effect that day remains unclear. News outlets reported that the president would not impose blanket tariffs but would focus on more industry-specific ones, and even though reciprocal tariffs are still on the menu, there might be exemptions for some countries. But officials cautioned that the situation could still change. The president also said additional tariffs on cars and pharmaceuticals would be coming soon.Read More

A federal judge refused to lift his order barring the government from deporting anyone under the rarely used Alien Enemies Act, which the Trump administration invoked to deport alleged Venezuelan gang members. An appeals court also held a hearing on the issue during which one judge said “Nazis got better treatment” under the act than the people who were recently deported, since the former got hearings.

Chinese EV-maker BYD made more than $100 billion in sales last year for the first time.

Turkish authorities arrested more than 1,100 people, including journalists, amid protests over the decision to jail a political rival of President Recep Tayyip Erdoğan.

South Korea’s Hyundai plans to invest ~$21 billion in the US, including $5.8 billion towards a steel plant in Louisiana.

Mia Love, the first Black Republican woman elected to Congress, has died of cancer at age 49.

Warren Buffett will pay $1 million to an employee who won his company’s March Madness bracket challenge—which Buffett made easier this year in hopes of having a winner—by correctly calling 31 of the 32 games in the first round of the men’s tournament. - Oil prices finish higher after Trump's threat to buyers of crude from VenezuelaOil futures settled higher on Monday after President...Read More

Oil futures settled higher on Monday after President Donald Trump said in a Truth Social post that countries that purchase oil from Venezuela will face a 25% tariff on all of their imports to the U.S. starting April 2. He also imposed new tariffs on Venezuela, according to the Associated Press.

The decision to impose tariffs on buyers of crude from Venezuela is "based on the alleged arrival of tens of thousands of Venezuelan migrants with violent backgrounds, which has been presented as a threat to U.S. national security," said Antonio Di Giacomo, a financial markets analyst at XS.

He said the impact on the energy market was immediate. Prices climbed Monday, with the May contract for West Texas Intermediate crude up 83 cents, or 1.2%, to settle at $69.11 a barrel on the New York Mercantile Exchange. May Brent crude settled at $73 on ICE Futures Europe, up 84 cents, or 1.2%.

- U.S. stocks end sharply higher Stocks jumped Monday on optimism that President Donald...Read More

Stocks jumped Monday on optimism that President Donald Trump may hold back from implementing some of his wide-ranging tariff plans and so the U.S. could skirt an economic slowdown from a protracted trade war.

The Dow Jones Industrial Average jumped 597.97 points, or 1.42%, to end at 42,583.32. The S&P 500 added 1.76% and closed at 5,767.57, while the tech-heavy Nasdaq Composite gained 2.27% to settle at 18,188.59.

Shares of Tesla which have fallen nine straight weeks, were up nearly 12%, adding to their Friday gains. Meta Platforms and Nvidia each climbed more than 3%.

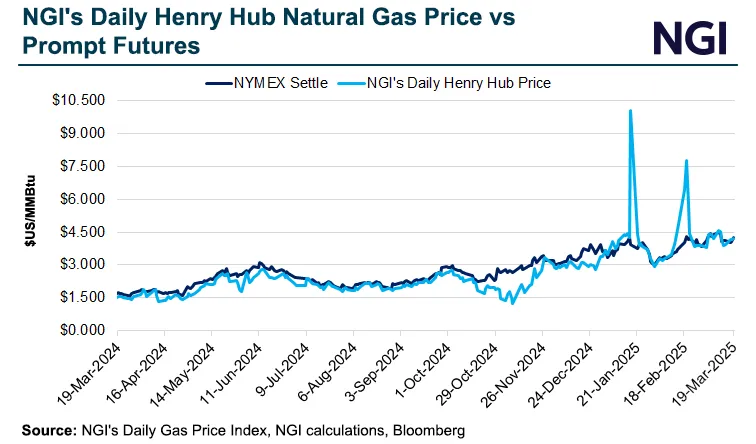

- As Stock Market Swoons Amid Tariff Fallout, Natural Gas Futures Prove Safe HavenDespite spring weather and rapidly fading heating demand, natural gas futures hold strong at winter price...Despite spring weather and rapidly fading heating demand, natural gas futures hold strong at winter price levels.Read More

To be sure, seasonally soft supply in storage and record levels of export demand are key drivers. However, traders said a stock market slump has proved to be another bullish factor for natural gas prices over the past month.

- Phillips 66's Lake Charles refinery may get $99M upgradePhillips 66 is pursuing a $99 million expansion of its 264,000-barrel-per-day...Phillips 66 is pursuing a $99 million expansion of its 264,000-barrel-per-day Lake Charles refinery in Louisiana, with proposed upgrades ranging from a steam turbine power generator to a naphtha fractionator. The project, under review for state tax incentives, could be finalized in late 2027.Read More

MOST POPULAR

-

255Exploration

255ExplorationRystad Predicts ‘Significant Risks’ to USA Operators

by Andreas Exarheas|RigZone.com| In a market update sent to Rigzone by the Rystad Energy...

-

255Oil & Gas News

255Oil & Gas NewsPearsall Shale Delivers Surprise Gusher in Frio County

A long-overlooked shale play in South Texas might finally be showing signs of promise,...

-

238Exploration

238ExplorationChevron to ‘Triple-Frac’ Half of Permian Oil Wells in 2025 to Cut Costs, Time

By Sheila Dang -HOUSTON | REUTERS—U.S. oil major Chevron told Reuters that it plans...

-

203Oil & Gas News

203Oil & Gas NewsTrump’s Tariff Policy Threatens ‘Golden Age’ of Oil & Gas

In the wake of President Donald Trump’s re-election in November 2024, his administration swiftly...

-

179Oil & Gas News

179Oil & Gas NewsChevron to Cut Jobs, Move HQ to Houston

Chevron Corporation has announced plans to lay off approximately 600 employees at its former...

-

119Oil & Gas News

119Oil & Gas NewsWhat Comes After the Shale Era Ends?

Over the past two decades, the U.S. shale revolution has dramatically transformed the global...

-

112Exploration

112ExplorationInterior Department Says More Oil Discovered Under Gulf of Mexico

(UPI) — The Department of Interior on Thursday released an analysis of fossil fuel...

-

109International

109InternationalCanadian Oil CEOs Brace for Recession, Avoid Panic Moves

As oil prices sink to their lowest levels in four years and the risk...

-

93Oil & Gas News

93Oil & Gas NewsWhere Next for Oil Prices?

by Andreas Exarheas|RigZone.com|Where next for oil prices? That’s the question Stratas Advisors looked at in...

-

87Oil & Gas News

87Oil & Gas NewsOil Prices Are Recovering, But Can Exporters Outlast the Tariff Circus?

By Irina Slav for Oilprice.com | Oil prices have been on the mend this...

-

68Oil & Gas News

68Oil & Gas NewsIndia Oil Import Price Drops Below $70 for the First Time Since 2021

By Tsvetana Paraskova for Oilprice.com | The average price of India’s crude oil imports...

-

40Midstream

40MidstreamKeystone Leak Fixed, Crude Oil Transport Resumes

On April 8, 2025, the Keystone Pipeline experienced a significant rupture near Fort Ransom,...