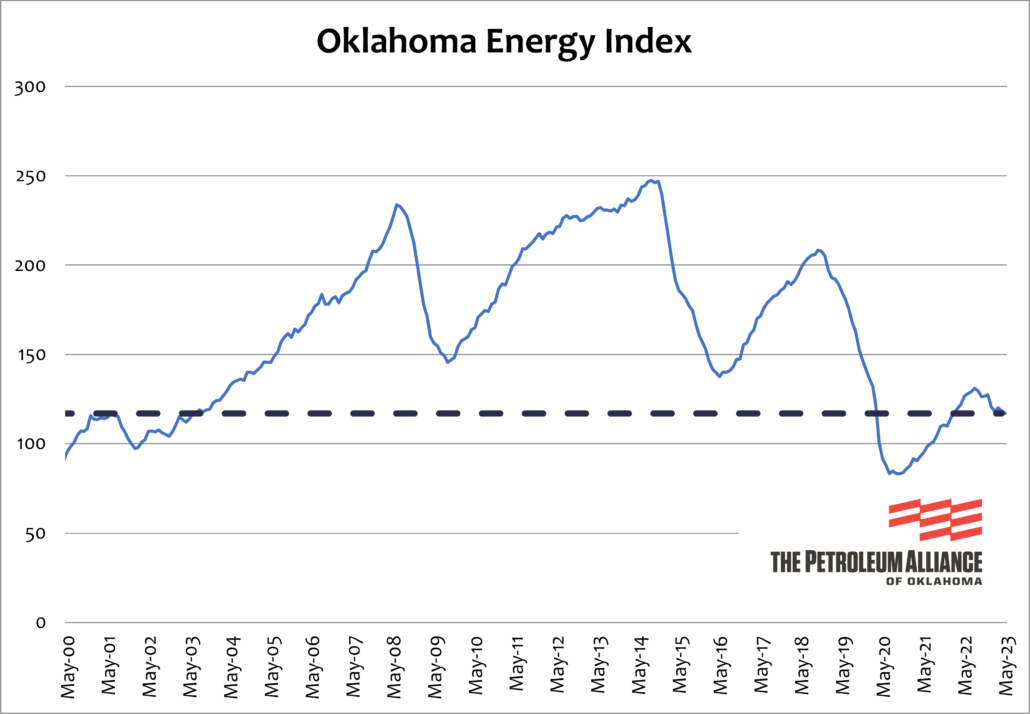

Story By Jerry Bohnen |OK Energy Today| A new Oklahoma Energy Index shows core inflation in the U.S. not only has driven oil and natural gas prices lower but taken the Energy Index with it.

The most recent Energy Index shows a 35% decrease in crude oil prices from one year ago and a 74% decrease in natural gas prices in the same time frame. Because of those decreased prices, the index of oil and natural gas activity in Oklahoma declined 0.7% in June and is 2.8% lower than year-ago levels. The current Energy Index stands at 116.9.

Supply and demand is Economics 101 for Oklahoma’s oil and natural gas industry.

As the world needs more oil and natural gas, the prices increase for the commodities Oklahoma oil and natural gas producers pull from beneath our state’s red soil. When demand falls, prices do the same.

Economic activity is slowing in the United States as core inflation remains a pocketbook issue in households across the country, tightening family budgets. Those economic anxieties paired with strong oil and gas production and storage data that shows an abundant supply have driven oil and natural gas prices lower, taking the Oklahoma Energy Index (OEI) with it.

Rig activity in Oklahoma fell from a weekly average of 56 active to just 39 rigs in July. Dr. Russell Evans, who compiles the OEI, said the fall in drilling activity is a result of oil and natural gas producers waiting out the lingering demand uncertainty and supply imbalance. Any hiring that would take place in 2023 has likely already happened, with little additional gains expected in the second half of the year.

Dr. Russell Evans

“Until this cycle passes, the energy demand will be muted, keeping downward pressure on prices,” Evans said. “Until the next growth cycle emerges, we expect Oklahoma producers to conserve capital and do their best to hold onto employees rather than add to personnel headcounts.”

Petroleum Alliance of Oklahoma President Brook A. Simmons said the ebbs and flows of commodity prices are a part of doing business in Oklahoma’s defining industry and weathering the bad times in order to succeed in the good is the key to success.

“Oklahoma’s oil and natural gas industry has proven itself resilient, but we are facing both price and policy headwinds,” Simmons said.

“I am confident decisions made in boardrooms and family offices today will provide for better days tomorrow. However, policymakers must understand the state’s defining industry is under stress and jobs will be lost in 2023 with an impact on Oklahoma’s budget.”

The OEI is a comprehensive measure of the state’s oil and natural gas economy established to track industry growth rates and cycles in one of the country’s most active energy-producing states. The OEI is a joint project of The Petroleum Alliance of Oklahoma and Thorberg Collectorate.