July 13, 2017, Bloomberg

Bob Ravnaas raised a paddle in a Houston auction house to secure his first block of mineral rights 19 years ago, when oil prices were swooning below $20 a barrel.

A generation later, that same West Texas oilfield is still spinning off royalties, part of a mineral-rights empire amassed by Ravnaas that stretches across 20 states and delivers millions of dollars in cash payments. Kimbell Royalty Partners LP, where the former petroleum engineer is now chief executive officer, has stakes in 48,000 oil and natural-gas wells in some of the hottest U.S. shale patches. These days, it’s not alone.

Bob Ravnaas

America’s drilling boom is making a hot commodity out of one of the stodgiest of oilfield assets, the monthly royalty check. Lured by the promise of steady returns without the cost of actually operating wells, companies like Kimbell are racing to acquire rights around the U.S. Private-equity giants including EnCap Investments LP and Blackstone Group LP are getting into the game as well, pouring billions into the market.

“It’s become a very attractive investment,” said Ravnaas, whose Fort Worth, Texas, company went public in February with a $90 million offering. “Oil and gas production has increased dramatically in the last ten years, and the size of the royalty market is increasing exponentially along with it.”

Drillers have negotiated with landowners for decades to tap the reserves below their acreage. But mineral rights have taken on new value as advanced drilling techniques sparked a renaissance in oilfields across the U.S. The rights guarantee holders an upfront bonus when an operator decides to drill and a cut of revenues for each barrel sold thereafter.

Generational Turnover

The growth in interest has been fueled by generational turnover. As time has passed, mineral rights have been passed down and diluted among successive generations. Descendants now see better value in packaging and selling off those rights for an upfront payment or equity in the new minerals companies, Ravnaas said.

In what was once a mom-and-pop business, $20 million deals with Texas cattle ranches or other major landowners have become more common, according to the CEO. Speculators are knocking on doors and blanketing mailboxes in hot shale plays, hoping to amass mineral rights for cheap before the drilling companies arrive.

Royalties typically range from an eighth of the per-barrel price to as high as a quarter in coveted areas like the Permian shale basin in Texas and New Mexico. Rights-holders aren’t on the hook for operating or financing costs to run the wells, although their income does depend on a driller’s willingness to keep pumping. Crude futures have fallen 14 percent in New York this year and were at $46.53 a barrel as of 10:06 a.m. on Friday.

“It’s effectively a zero-cost exposure to the minerals” said Brian Brungardt, a Stifel Nicolaus & Co. analyst in St. Louis. He tracks Kimbell and two other royalty-chasing partnerships, Black Stone Minerals LP (no relation to the equity firm) and Viper Energy Partners LP.

20 Million Acres

Collectively, the companies have spent more than $120 million to acquire new rights this year and now hold a claim on oil and gas royalties from more than 20 million acres in the Permian, Bakken, Marcellus and other shale fields, according to corporate filings.

Private equity firms have jumped in as well, seeing mineral rights as a more affordable entree into the U.S. shale boom.

In the Permian, drilling rights have reached $40,000 an acre and higher in the past year. The top price for mineral rights in the area is closer to $20,000 an acre, although competition has been pushing the tab up, said Rich Aube, co-president of New York-based Pine Brook Partners. The firm has devoted more than $100 million to royalty investments, including Brigham Minerals LLC.

“It’s a new way to invest in the same resources in a way that’s less capital-intensive,” Aube said in a telephone interview. “You have a lot of folks who want exposure to these resources with a different risk profile and have found this more attractively priced.”

Encap, Blackstone

Houston-based EnCap, among the biggest energy-focused buyout firms, has devoted $1 billion to mineral investments, while New York-based Blackstone has invested more than a half-billion dollars. Aube said he knew of at least a dozen other equity firms that have assembled their own minerals teams.

Representatives at EnCap and Blackstone declined to comment.

The firms are pitching mineral rights as a new asset class for investors seeking better returns in a world of ultra-low interest rates.

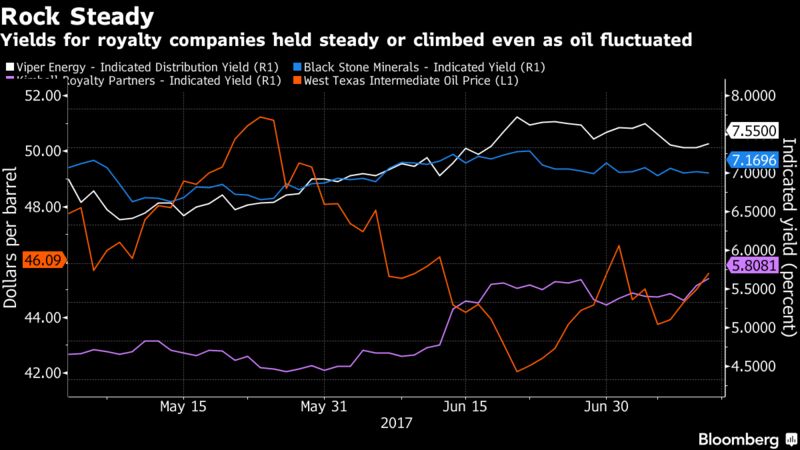

Viper Energy and Black Stone Minerals pay quarterly distributions that yielded more than 7.2 percent apiece as of this week, while Kimbell’s yield was projected at 5.6 percent, according to data compiled by Bloomberg. Each beats the average investment-grade energy bond yield of about 3.5 percent, according to Bloomberg Barclays index data.

“You’ve got hundreds and hundreds of landmen that are constantly putting together an acre here and an acre there and then selling,” said R. Davis Ravnaas, Kimbell’s chief financial officer and the CEO’s son. “We meet a new team almost every week.”

The risk for royalty collectors is that they’re at the mercy of a third party — oil companies — to keep the petroleum pumping. Kimbell reported a net loss in each of the last three years, after more than $40 million in writedowns related to slumping oil and gas prices.

Despite those paper losses, cash flow and production continued to grow, the company said in an emailed statement. Kimbell credited “a highly tuned acquisition strategy which focuses on only buying high quality properties with ongoing development and upside potential.”

The market’s volatility puts a premium on having the right executive team, said Brungardt, the Stifel analyst.

“You need a team in place that has got the experience in not only analyzing reserves and well economics but also the acquisition side,” he said. “You may be sitting on a lot of acreage, but if nobody’s interested in it, you are out of luck.”

“It’s critically important to purchase not only the right rocks but the right rocks operated by the right operators,” added Aube, of Pine Brook Partners. “You don’t control the pace of drilling, but that’s a judgement that affects the value of your asset and what your cash flow is going to look like over time.”

SOURCE: Bloomberg

About Oklahoma Minerals Founder GIB KNIGHT

Gib Knight is a private oil and gas investor and consultant, providing clients advanced analytics and building innovative visual business intelligence solutions to visualize the results, across a broad spectrum of regulatory filings and production data in Oklahoma and Texas. He is the founder of OklahomaMinerals.com, an online resource designed for mineral owners in Oklahoma.