Story by Jennifer Pallanich. Talos Energy Inc. plans to buy EnVen Energy Corp. in a $1.1 billion deal that increases Talos’ Gulf of Mexico production by 40%.

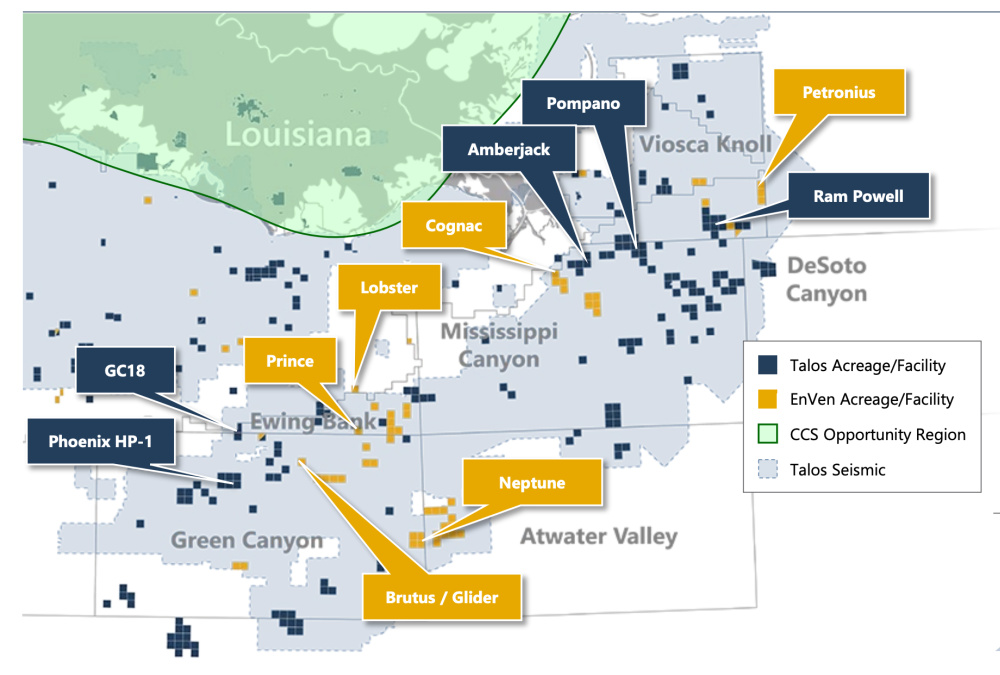

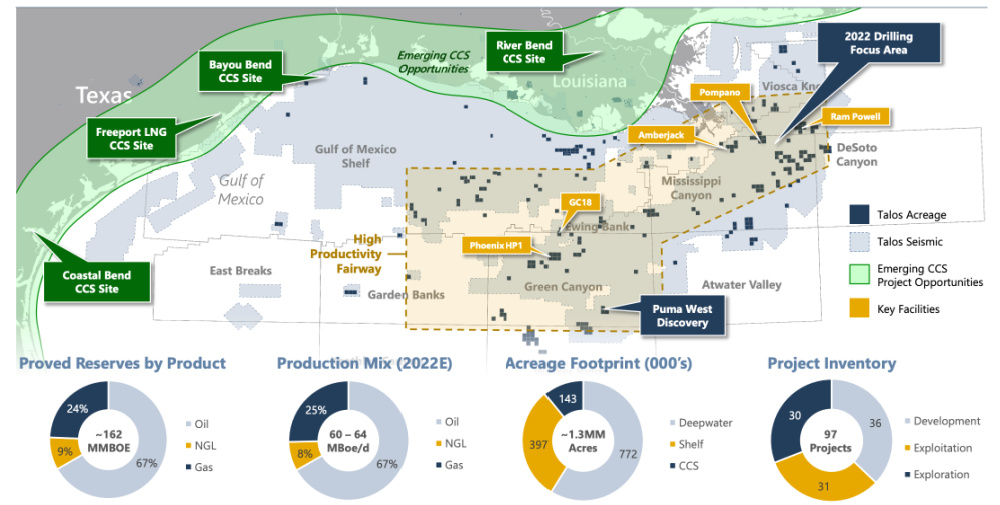

The acquisition of EnVen, a private operator, doubles Talos’ operated deepwater facility footprint, adding key infrastructure in existing Talos operating areas. More than 80% of the combined assets will be deepwater, with Talos operating more than 75% of the acreage it holds interests in. In a presentation regarding the deal, Talos said the contiguous operated asset portfolio provides a “hand-in-glove fit in deepwater Gulf of Mexico core areas.”

During a conference call on Sept. 22 discussing the deal, CEO Timothy S. Duncan said the EnVen purchase “just checks a lot of boxes” in terms of scale, assets, similar strategies and what Talos is doing from a technology standpoint.

“We’re trying to build a leadership position in a basin we’ve known for a long time,” he said. “This gives us more of a presence around our stakeholders as we grow the company in the Gulf Coast region.”

And the purchase of EnVen, which is expected to close by the end of the year, is one critical part of that. The purchase is expected to generate $30 million or more annually in synergies related to general and administrative cost reductions. But it also expands the company’s Gulf of Mexico footprint with acreage Talos has previously attempted to acquire.

“We’re familiar with these assets,” he said. “I’m looking at assets I smile about when I look at, because we bid on them.”

EnVen holds 78 MMboe of 2P reserves and 420,000 gross acres in the Gulf of Mexico. The deal also adds about 24,000 boe/d to Talos’ production stream.

The EnVen asset mix is “similar to what our facilities look like,” he added. “They were put in by majors and have been well taken care of.”

EnVen operates the Brutus/Glider asset in 2,900 feet to 3,243 ft water depth with 100% interest. The production facility has gross capacity of 120,000 bbl/d. EnVen’s operated Lobster Field in 775 ft of water as gross oil capacity of 80,000 bbl/d. EnVen holds 67% working interest in the field.

Duncan said Lobster had been “tremendous” for EnVen, which has an active rig program committed for the field.

“We’re just going to step in and execute that plan,” he said.

The EnVen-operated Cognac Field in 1,023 ft of water has a gross oil capacity of 30,000 bbl/d. The company holds 63% interest in that field. EnVen operates Neptune with 65% interest. With a gross oil capacity of 50,000 bbl/d, the field is in 4,250 ft water depth.

Prince, which EnVen operates with 100% interest, is in 1,500 ft of water and has a gross oil capacity of 50,000 bbl/d. EnVen holds 50% interest in the Chevron Corp.-operated Petronius Field in 1,754 ft water depth. It has gross oil capacity of 60,0000 bbl/d.

Duncan said the expectation is the mix of Talos and EnVen deepwater facilities will encourage more subsea tieback activity for unused capacity at the various production units.

“There will be ample capacity for future subsea tiebacks,” Duncan said.

EnVen currently had around three dozen subsea tieback ideas rolling through their inventory. Duncan said Talos would pull together those ideas during planning for 2023, 2024 and 2025 spending programs.

“They’ve built a very healthy business, or they won’t be here,” he said. “We like what they’re doing, right out of the box.”

Consideration for the transaction consists of 43.8 million Talos shares and $212.5 million in cash, plus the assumption of EnVen’s net debt upon closing, currently estimated to be $50 million at year-end 2022.

Following the transaction, Talos shareholders will own approximately 66% of the pro forma company and EnVen’s equity holders will own the remaining 34%. The transaction has been unanimously approved by each company’s board of directors. Closing is expected by year-end 2022, subject to customary closing conditions.

The company said the deal implies a valuation of approximately 2.4x 2022 estimated hedged adjusted EBITDA with the transaction more than 13% accretive to Talos shareholders on 2023E free cash flow per share. Talos expects the transaction to be immediately de-leveraging at closing, with year-end 2022 leverage of less than 0.8x. Additionally, Talos will have no near-term maturities. The company expects to provide 2023 financial guidance after closing.

The purchase also means a shake-up on the Talos board of directors, which includes a slate of members who serve staggered three-year terms. On closure, all directors must be elected every year going forward, with two from EnVen and six from Talos. Robert Tichio, the current Riverstone Holdings representative, will step down from the board when the transaction closes.