Story from Hart Energy: Exxon Mobil said on May 19 that it signed an agreement with subsidiaries of Denver-based BKV Corp. for the sale of operated and non-operated Barnett Shale gas assets in Texas for $750 million with additional payments contingent on future natural gas prices.

“We are focused on delivering the most competitive returns to our shareholders by developing opportunities with the lowest cost of supply and further strengthening our industry-leading upstream position,” Liam Mallon, president of Exxon Mobil Upstream Co., said in a press release.

“Our subsidiaries have operated in the Barnett Shale safely and responsibly for nearly two decades,” Mallon added, “and we are encouraged by BKV’s plans to develop the resource in line with its stated pathway to net-zero greenhouse gas emissions by 2025.”

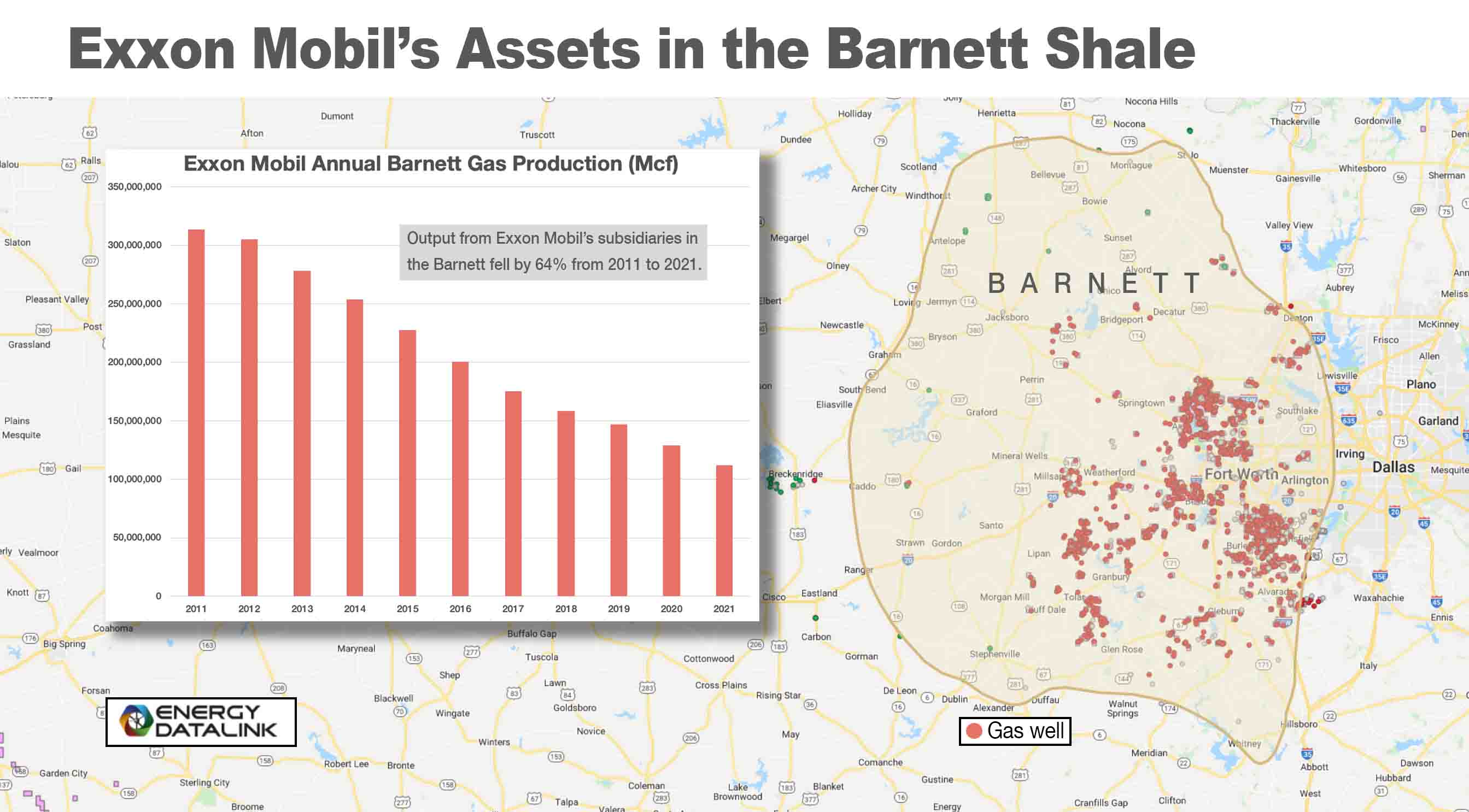

Exxon Mobil removed the Barnett Shale gas assets operated by its subsidiaries XTO Energy Inc. and Barnett Gathering LLC from its development plan in 2020.

The company is looking to sell assets in Asia, Africa, and Europe as it focuses on ventures in Guyana, offshore Brazil and the Permian Basin of West Texas and New Mexico.

As part of the agreement, all employees with Exxon Mobil subsidiaries in the Barnett Shale will receive full employment offers with BKV. The sale is expected to close in the second quarter of 2022.

Related: Texas court sides with Barnett Shale Mineral owners

LEASING OR SELLING OIL & GAS MINERAL RIGHTS

If you or your family members are considering leasing to an oil company or selling your mineral rights in Oklahoma or Texas, go visit redriverhub.com, the premier oil, and gas mineral rights platform where mineral owners can lease or sell their mineral rights. Red River Hub is a site built by mineral owners for mineral owners.