Exxon Mobil Corp.’s deal in January for a swath of Permian Basin drilling real estate came with a sweetener for the sellers. The heirs of oil tycoon Perry Bass will get $1 billion in cash by 2032 — if drilling goes well for Exxon.

“I sometimes suggest them as alternatives to my clients,” said Michael Byrd, an Akin Gump Strauss Hauer & Feld LLP partner in Houston who advises on oil and gas deals. “They are used to bridge the bid and ask.”

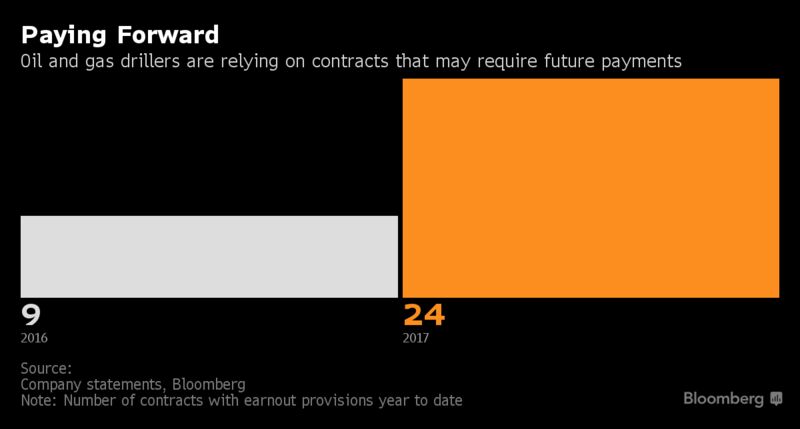

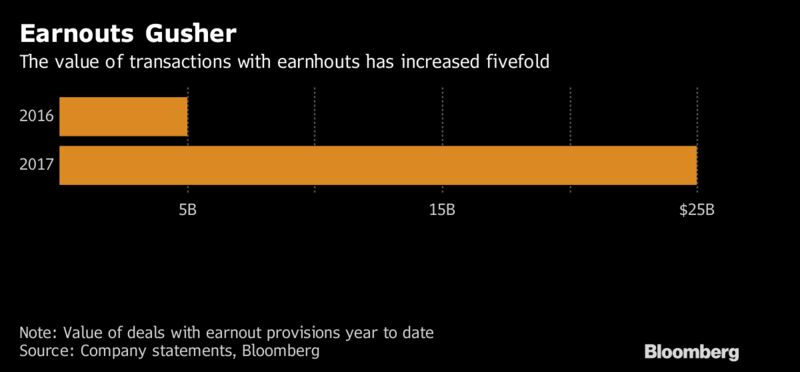

At least 24 oil and gas deals in the U.S. and Canada with a combined value of more than $25 billion have included earnouts so far this year, according to a review of deal announcements. That review turned up only nine such deals, totaling more than $5 billion, over the same period last year.

The rise in earnouts coincides with a slump in dealmaking in 2017 after last year’s rebound in oil and natural prices spurred a takeover boom. North American energy mergers totaled about $135 billion through the end of October, a decline of more than 25 percent from a year earlier, according to data compiled by Bloomberg. U.S. shale producers’ rising output contributed to a global oil glut that sent crude prices tumbling this summer before rallying in the fall.

That volatility has created uncertainty that earnouts are designed to address.

“In some cases, they are used to reduce exposure to large commodity price swings,” Byrd said. “While in others, they are used to protect against uncertainty as to the future development potential of currently undeveloped acreage.”

Year’s Biggest

The largest deal with an earnout this year was Cenovus Energy Inc.’s $13.3 billion purchase in May of Canadian oil assets from ConocoPhillips, which will get extra payments over five years if prices for West Canada Select top C$52 ($40.53) a barrel. If oil averages C$60 a barrel, for example, Conoco would get about C$200 million a year, Conoco executives told analysts when announcing the deal in March. West Canada Select was trading at C$55.18 on Monday, according to data compiled by Bloomberg.

“We did the Canadian transaction because they were willing to put in a contingent payment,” Conoco Chief Executive Ryan Lance said at an energy conference in June, according to a transcript compiled by Bloomberg. “They were willing, and we get half of that upside. So, that’s the only way we would sell oil-based assets in this kind of a market.”

Conoco’s $2.7 billion sale of its natural gas holdings in New Mexico to Hilcorp Energy Co. also had an earnout. So did many others: Laredo Petroleum Inc.’s $1.8 billion sale of its stake in pipeline operator Medallion Gathering & Processing LLC to Global Infrastructure Partners; Noble Energy Inc.’s $1.1 billion sale of natural gas assets in West Virginia and Pennsylvania to Quantum Energy Partners LLC; and Targa Resources Corp.’s $565 million purchase of most of pipeline operator Outrigger Energy LLC.

Earnouts can make sense in deals for companies operating in newly developing basins where there isn’t a lot of historical drilling data, said Ali Akbar, a managing director with Royal Bank of Canada’s RBC Capital Markets who specializes in energy pipeline deals.

‘Fair Value’

They help sellers “get to what they deem to be a fair value,” Akbar said. “Buyers can feel that they didn’t overpay upfront. So basically, a win-win.”

RBC advised Targa on its purchase of Outrigger, which controls a network of oil and gas gathering pipelines in a fast-growing portion of the Permian known as the Delaware Basin. The deal calls for Targa pay as much as $935 million more in 2018 and 2019 to Outrigger’s former owner, Denham Capital Management, depending on how much it makes on contracts with the customers Outrigger had when the deal closed in March. New customers don’t count.

The earnout “de-risked” the transaction, Targa Chief Financial Officer Matthew Meloy said in a conference call with analysts in January.

“Strong performance from those contracts would be very good for the sellers and very good for our” investors, Meloy said. “The bigger that payment is, the more cash flow there is.”

Earnouts aren’t headache free.

They can be tough to negotiate because parties have to agree on what will trigger payouts, how big they will be and how long they will last. Sellers often want a say in how the buyer operates the target to assure they get paid, a concession nobody likes to make.

Buyer Beware

Earnouts also can have potentially negative tax consequences for the buyer, said John Grand, a Vinson & Elkins LLP partner in Dallas who advises on energy deals. While earnout payments can be deducted as part of the overall purchase price, the extra revenue triggering them may be taxed as ordinary income at a much higher rate.

They tend to be an option of last resort in negotiations for a company that failed to sell in an auction or had a deal with another buyer fall through, according to Grand.

“Buyers need to beware,” he said

The buyout firm Quantum Energy Partners had a tentative agreement this year to sell Permian basin explorer ExL Petroleum Management to a Russian investment firm that fell apart because of regulatory concerns, people familiar with the matter said in June. Quantum then agreed to sell ExL to Carrizo Oil & Gas Inc. for $648 million plus as much as $125 million more in earnout payments, depending on future oil prices.

“Both sides, generally, prefer not to have earnouts,” Grand said.“It’s hard to really put a value on what you are getting and what the likelihood of getting that payment is.”

SOURCE: Matthew Monks Bloomberg

Compiled and Published by GIB KNIGHT

Gib Knight is a private oil and gas investor and consultant, providing clients advanced analytics and building innovative visual business intelligence solutions to visualize the results, across a broad spectrum of regulatory filings and production data in Oklahoma and Texas. He is the founder of OklahomaMinerals.com, an online resource designed for mineral owners in Oklahoma.