Chesapeake Energy (CHK) announced last week its exit from the Mississippian Lime, the play that the company helped to pioneer several years ago. Chesapeake received an estimated $1,000 per acre for its Miss Lime acreage, excluding production. The $0.5 billion price tag received for the properties is viewed as a success for Chesapeake.

OIL ANALYTICS views the price received as reasonable and the transaction as a positive, albeit hardly material, development for the stock.

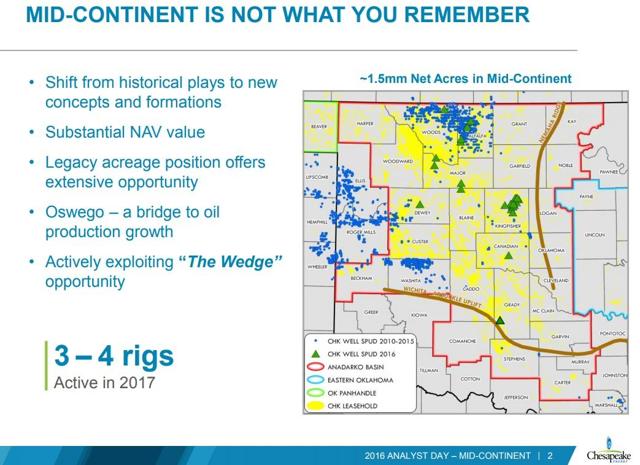

Given the improvement in oil prices, Chesapeake is likely to put additional asset packages in the Mid-Continent on the auction block.

Transaction Metrics

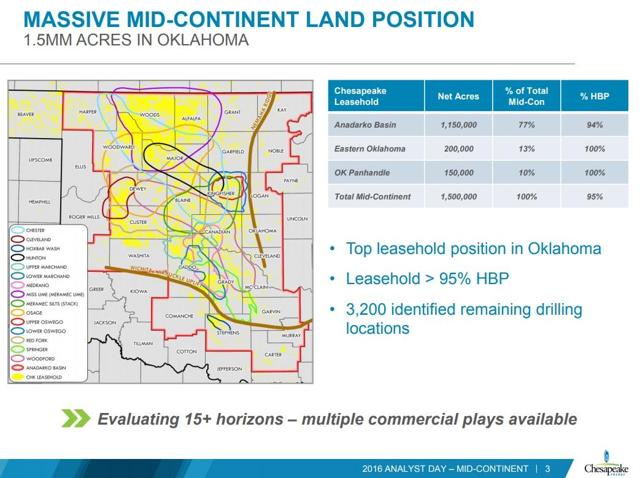

In three separate transactions, Chesapeake is selling ~238,000 net acres, including interests in 3,000 wells that are currently producing 23,000 barrels of oil equivalent per day net to Chesapeake. Oil represents ~25% of the production mix.

It appears that the acreage being sold mostly corresponds to the purple Miss Lime contour on the map below. As a reminder, Chesapeake has a 50/50 joint venture with Sinopec in the area.

The disclosed production metrics indicate that the vast majority of the wells being sold are stripper wells. Indeed, based on our estimate of Chesapeake’s average working interest in the properties of ~39% and average royalty burden of ~15%-20%, average oil production per well comes out at around 6 barrels per day. Given that some wells were put on production recently and have substantially higher current production rates, the average rate for older vintage wells is probably in the 3-5 barrels per day range.

Please note that not all of the 3,000 wells on the properties are Miss Lime wells. In fact, we estimate that Miss Lime wells represent less than one-quarter of the total count, with the balance being mostly legacy vertical wells. The Miss Lime wells are depicted on the map below by the dense cluster of blue dots in Alfalfa and Woods Counties.

Needless to say, oil-producing stripper wells are typically characterized by high operating costs. Operating costs can be particularly high for Miss Lime wells due to high water cuts.

So why are the buyers willing to pay half a billion dollars for properties that are producing less than 5,000 barrels of oil per day, have been extensively drilled and have a high operating cost?

Several factors could be the reason:

- A large portion of production is obviously quite mature and is characterized by a relatively low decline rate – which makes it more valuable.

- The buyer may find some promise in other zones on this stacked-pay acreage, which is held by production and represents a long-term exploration option in the event oil prices move significantly higher.

- The acquirer may be betting on achieving a meaningful increase in production volumes via workovers (which, arguably, were not the top capital allocation priority for Chesapeake).

- The sale includes production infrastructure that was originally configured for larger volumes and may have some value.

Assuming that the market value of the existing production is $250 million, the price received for the acreage is $1,000 per acre. We note again that the acreage has been significantly exploited. While several new play concepts have been advertised by Chesapeake and its peers, the success of those new plays is yet to be demonstrated. In this context, the price per acre received is quite reasonable. Given Chesapeake’s existential priority to reduce its leverage via asset sales, the outcome is a positive for the stock, in our view.

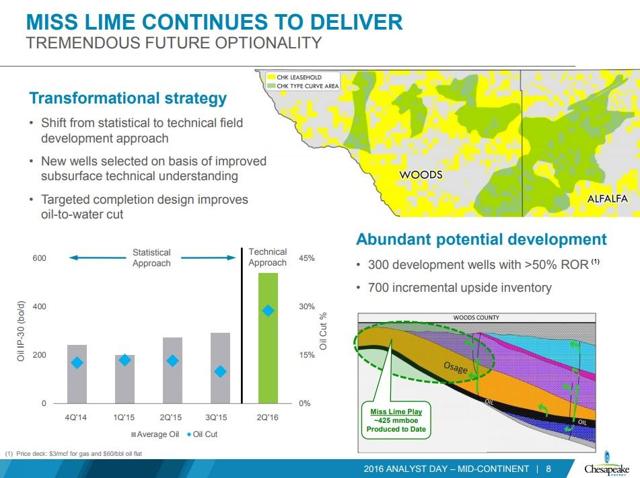

“Tremendous Future Optionality”

At its Analyst Day in 2016, Chesapeake highlighted its Miss Lime assets as “continuing to deliver” and having “tremendous future optionality.” In reality, however, Chesapeake’s net oil production from its Miss Lime asset has declined by one-half since 2014 (based on OIL ANALYTICS’ estimate) – far more than any other major asset in the portfolio. The decline indicates that the asset could not compete for capital the same way other assets could, despite the massive installed operating infrastructure.

There is no dispute that the Anadarko Basin – even in its northern shelf area – is a prolific oil producing province and some future upside from the acreage should not be discounted. That said, the going price for the acreage in this area speaks volumes about the industry’s risk/reward perception.

Plenty of Acreage Left

Following the divestiture, Chesapeake’s acreage position in the Mid-Continent remains massive and appears to be a logical component of the company’s asset monetization bank. Piece-by-piece divestitures appear to be most likely.

SOURCE: Seeking Alpha Richard Ziets

Compiled and Published by GIB KNIGHT

Gib Knight is a private oil and gas investor and consultant, providing clients advanced analytics and building innovative visual business intelligence solutions to visualize the results, across a broad spectrum of regulatory filings and production data in Oklahoma and Texas. He is the founder of OklahomaMinerals.com, an online resource designed for mineral owners in Oklahoma.