Story By Emily Patsy. Marathon Oil Corp. agreed to acquire Ensign Natural Resources on Nov. 2, nearly doubling the Houston-based company’s position in the Eagle Ford Shale in a $3 billion cash deal, CEO Lee Tillman said.

“This acquisition in the core of the Eagle Ford satisfies every element of our exacting acquisition criteria, uniquely striking the right balance between immediate cash flow accretion and future development opportunity,” commented Tillman, who also serves as chairman and president of Marathon Oil.

Based in Houston, Ensign was formed in 2017 in partnership with Warburg Pincus, a global growth investor. The company also secured an equity commitment from the Kayne Private Energy Income Funds platform in 2019 as part of an acquisition of Pioneer Natural Resources Co.’s Eagle Ford assets.

Ensign later bolstered its Eagle Ford position further with the purchase of Reliance Eagleford Upstream Holding LP, a step-down subsidiary of India’s Reliance Industries Ltd., for an undisclosed amount. The 2021 deal, which represented an exit from U.S. shale by Reliance, increased Ensign’s current ownership to 100% in the leases and wells it acquired from Pioneer in 2019 and Newpek LLC in 2020.

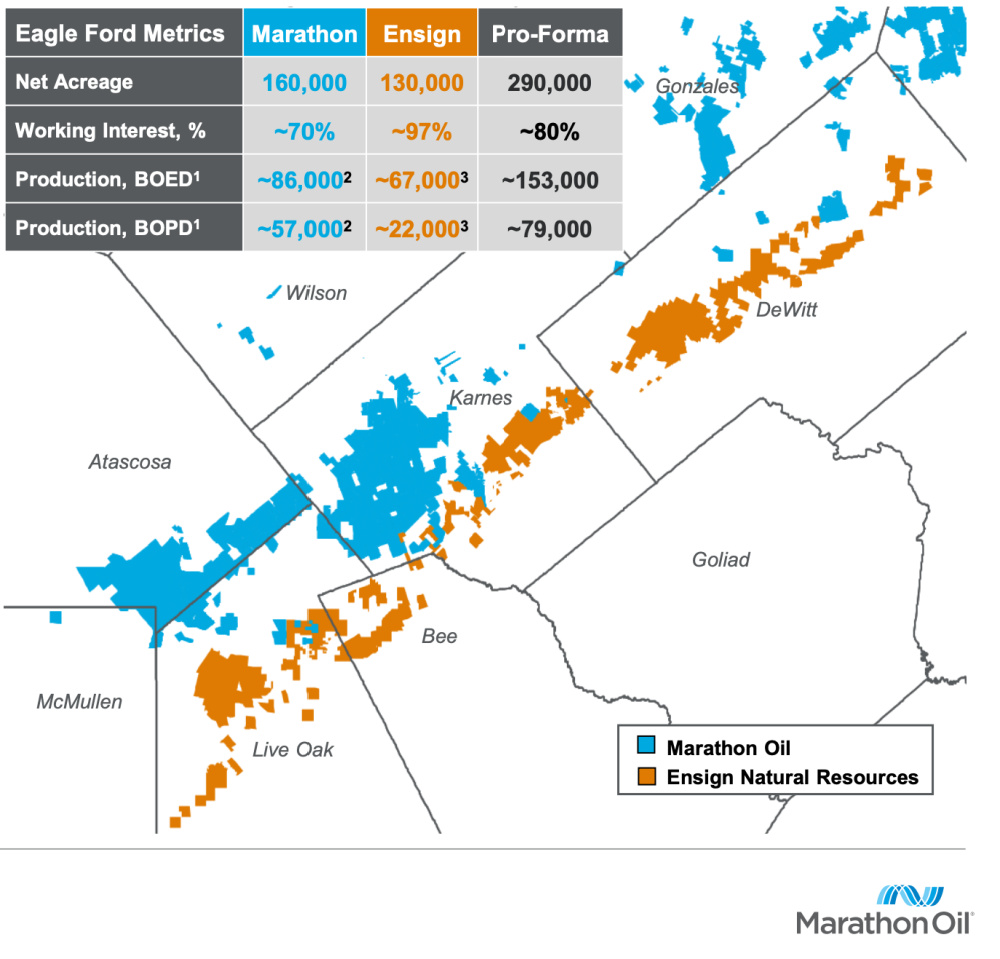

Through its acquisition of Ensign, Marathon Oil said it will gain 130,000 net acres (99% operated, 97% working interest). The acreage is adjacent to Marathon Oil’s existing Eagle Ford position and spans Live Oak, Bee, Karnes and Dewitt counties in South Texas across the condensate, wet gas and dry gas phase windows of the Eagle Ford, according to a company release on Nov. 2.

In total, the Ensign transaction will materially increase Marathon Oil’s scale in the Eagle Ford Shale to 290,000 net acres and contribute to optimized supply chain accessibility and cost control in a tight service market, the company said in the release.

The Ensign inventory in the Eagle Ford Shale is among the most capital efficient in the Lower 48, according to Marathon Oil. (Source: Marathon Oil investor presentation)

RELATED: Marathon Oil holds its course

Marathon added in the release the Ensign transaction adds “significant high return, high working interest inventory that immediately competes for capital and is accretive to Marathon Oil inventory life.” However, the company plans to hold fourth-quarter production flat with approximately one rig and 35 to 40 wells to sales per year.

The estimated production of the Ensign assets for the fourth quarter is 67,000 net boe/d, or 22,000 net bbl/d of oil. The company estimates it is acquiring more than 600 undrilled locations, representing an inventory life greater than 15 years.

Marathon also added its valuation of the asset was based on the maintenance level program and does not include any synergy credits or upside redevelopment opportunity.

The company is planning to fund the transaction with a combination of cash on hand, borrowings on its revolving credit facility and new prepayable debt. As a result, Marathon does not expect the transaction to meaningfully affect its leverage profile.

“Importantly, we expect to execute this transaction while maintaining our investment grade balance sheet and while still delivering on our aggressive return of capital objectives in 2022 and beyond,” Tillman noted in the release.

The transaction is subject to customary terms and conditions, including closing adjustments, and is expected to close by year-end 2022.

Morgan Stanley is serving as the lead financial adviser to Marathon Oil and is providing committed financing to Marathon Oil with respect to a portion of the purchase price. White & Case LLP is serving as outside legal counsel for Marathon Oil.

Evercore and J.P. Morgan Securities LLC are financial advisers to Ensign Natural Resources. Sidley Austin LLP is principal legal adviser to Ensign Natural Resources.